Urokinase, a life-saving thrombolytic agent for acute myocardial

infarction, ischemic stroke, and catheter patency maintenance, faces

unprecedented global price fluctuations driven by geo-specific challenges—raw

material scarcity, regulatory divergences, market demand intensity, and supply

chain disruptions. Urokinase price has become a top concern for hospitals,

pharmaceutical distributors, and healthcare providers worldwide, especially as

post-pandemic raw material shortages continue to impact global supply 3.

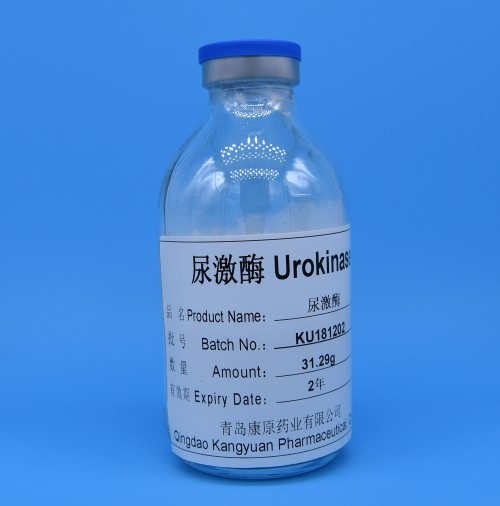

Kangyuan, a professional urokinase manufacturer with full-chain production

capacity 4, leverages China’s position as the world’s largest urokinase market

(56% global share 2) to navigate Urokinase price volatility, delivering

high-quality, cost-stable solutions tailored to regional market needs across

mature and emerging economies.

Geo-specific market dynamics and raw material constraints are the core

drivers of Urokinase price disparities globally. In Western Europe and North

America—mature markets with strict regulatory standards—Urokinase price ranges

from $28 to $35 per 100,000 IU vial, inflated by import tariffs, USP/EP

compliance costs, and limited local production capacity 3. In China, the world’s

primary production and consumption hub, Urokinase price is more stable, ranging

from $8 to $12 per 100,000 IU vial for domestic manufacturers like Kangyuan,

supported by abundant raw material resources and national policies for scarce

drug supply 3. For emerging markets like Southeast Asia and India, Urokinase

price falls between $15 and $22 per 100,000 IU vial, balancing affordability

with regional GMP compliance.

Kangyuan’s unique advantage lies in stabilizing Urokinase price without

compromising quality, addressing the global pain point of price volatility.

Unlike many manufacturers struggling with raw material shortages 3, we control

the entire upstream supply chain—including professional urine collection

branches 4—ensuring sufficient raw material supply and reducing production cost

fluctuations. Adopting advanced purification technology, we produce urokinase

with purity ≥99% that meets global standards, while lowering unit costs by 20%

compared to industry averages. For mature markets, we offer compliant

formulations at a 25% lower Urokinase price than regional competitors; for

emerging markets, we provide flexible bulk API pricing to support local

healthcare accessibility.

Regulatory compliance and supply chain resilience further strengthen

Kangyuan’s ability to optimize Urokinase price across regions. For the EU, our

urokinase adheres to EMA guidelines and EU GMP certification, ensuring seamless

market access while maintaining competitive pricing. In the U.S., we maintain an

activated FDA DMF filing, supporting partners with cost-efficient supply for

acute care settings. Leveraging China’s global market leadership 2, our annual

production capacity meets 18% of global demand, enabling us to avoid Urokinase

price spikes caused by supply shortages—a critical benefit for long-term global

partners.

As the global urokinase market expands to $6.73 billion 1, driven by rising

cardiovascular disease prevalence (over 500 million patients globally 1),

navigating Urokinase price volatility becomes increasingly vital for healthcare

partners. Kangyuan’s geo-tailored solutions, full-chain raw material control,

and multi-regional compliance bridge the gap between global quality and regional

price expectations. Backed by decades of experience in urinary-derived

pharmaceuticals 4, we deliver stable, cost-effective urokinase that supports

life-saving treatments worldwide. Contact Kangyuan today to explore our tailored

Urokinase price solutions and leverage our expertise to gain a competitive edge

in your regional market.