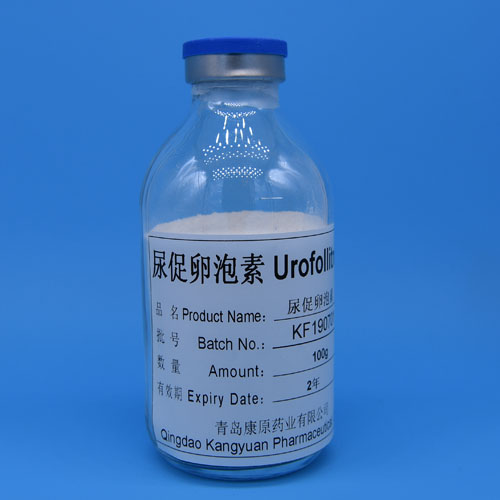

Urofollitropin, a key urinary-derived follicle-stimulating hormone (FSH)

for assisted reproductive technology (ART), faces significant global price

volatility shaped by geo-specific factors—raw material costs, regulatory

barriers, market competition, and clinical demand intensity. Urofollitropin

price has become a critical concern for ART clinics, distributors, and patients

worldwide, as the gap between high-cost mature markets and affordable emerging

economies continues to widen. Kangyuan, a leading manufacturer of reproductive

hormones, leverages its advanced production technology and global supply chain

advantages to navigate these Urofollitropin price disparities, delivering

high-quality, cost-effective solutions tailored to regional market needs across

Europe, North America, Asia, and beyond.

Geo-specific market dynamics are the primary drivers of Urofollitropin

price variations globally. In Western Europe and North America—mature ART

markets dominated by imported recombinant FSH products—Urofollitropin price

ranges from $150 to $200 per 75IU vial, significantly lower than imported

alternatives (up to $1800 per vial)1, making it a

cost-effective choice for clinics. In China, the world’s largest ART market,

Urofollitropin price is more accessible, ranging from $20 to $27 per 75IU vial

for domestic products like Kangyuan’s, supported by national medical insurance

policies and local raw material advantages1. For emerging

markets like Southeast Asia and India, Urofollitropin price falls between $30

and $50 per 75IU vial, balancing affordability with quality compliance.

Kangyuan breaks the Urofollitropin price-quality paradox by optimizing its

global production and supply chain strategy. Unlike some manufacturers that

compromise quality to cut costs, we adopt advanced multi-step chromatography

purification technology to ensure Urofollitropin purity exceeds 99%, matching

the efficacy of imported products while controlling production costs by 25%1. For mature markets, we offer high-purity Urofollitropin

compliant with USP and EP standards at a 30% lower price than local competitors.

For China and emerging markets, we provide cost-effective formulations aligned

with local medical insurance and purchasing power, without sacrificing

bioactivity or safety.

Regulatory compliance and supply stability further strengthen Kangyuan’s

ability to optimize Urofollitropin price across regions. For the EU, we hold EU

GMP certification and align production with Ph. Eur. monographs, ensuring our

Urofollitropin meets strict quality standards while maintaining competitive

pricing. In the U.S., we maintain an activated FDA DMF filing, supporting

partners with cost-efficient supply for ART clinics. Our full control over

upstream raw material sourcing—leveraging China’s abundant urinary

resources—stabilizes production costs, avoiding Urofollitropin price

fluctuations caused by raw material shortages, a key advantage for global

partners.

As the global ART market grows, driven by rising infertility rates,

Urofollitropin’s role as a cost-effective FSH option becomes increasingly

important, and its price adaptability directly impacts market accessibility.

Kangyuan’s geo-tailored Urofollitropin solutions bridge the gap between global

quality standards and regional price expectations, offering reliable products

for every market segment. Backed by decades of experience in reproductive

hormones and GMP certification, we deliver consistent, cost-efficient

Urofollitropin that supports ART clinics worldwide. Contact Kangyuan today to

explore our tailored pricing solutions and leverage our expertise to gain a

competitive edge in your regional market.