As a critical thrombolytic agent for acute myocardial infarction, ischemic

stroke, and pulmonary embolism, Urokinase faces unprecedented price volatility

globally, driven by geo-specific factors including raw material shortages,

regulatory differences, and clinical demand variations. Urokinase price has

become a focal point for hospitals, distributors, and pharmaceutical partners,

especially amid recurring urine-sourced raw material constraints— the core input

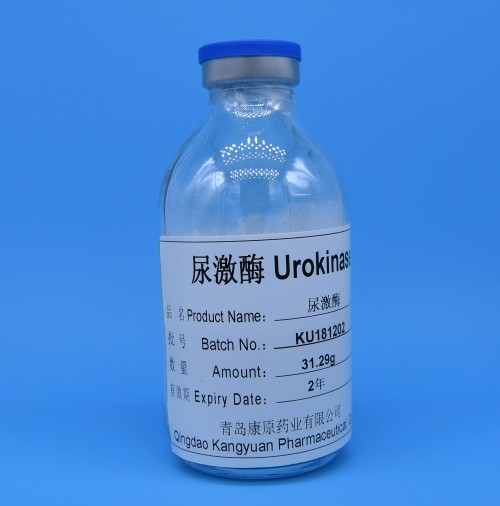

for Urokinase production6. Kangyuan, a leader in thrombolytic

drug innovation and supply chain resilience, delivers geo-adapted Urokinase

solutions, balancing stable pricing with uncompromised quality to address

diverse regional needs, from cost-sensitive emerging markets to strict

regulatory-driven mature markets.

Geo-specific supply chain challenges are the primary driver of Urokinase

price disparities across global markets. In China— the world’s largest Urokinase

production hub2—Urokinase price has surged by 350% since

2020, from $4 per 100,000 IU to over $18, due to pandemic-induced urine source

shortages and strict environmental regulations6. For mature

markets like Europe and the U.S., where imported Urokinase dominates, prices are

even higher (up to $30 per 100,000 IU) due to tariffs and compliance costs,

though demand remains stable for its proven efficacy in acute thrombolysis1. In contrast, emerging markets like India and Southeast Asia

see more moderate Urokinase price ranges, supported by local partnerships that

reduce logistics and regulatory barriers3.

Kangyuan breaks the Urokinase price-quality paradox through geo-tailored

pricing strategies and supply chain optimization. Leveraging our control over

upstream urine raw material sourcing and advanced purification technology, we

stabilize production costs, enabling competitive Urokinase price across regions.

For China’s domestic market— where Urokinase is a Class A medical insurance

product1—we offer cost-effective formulations compliant with

national volume-based procurement (VBP) policies. For the EU and U.S., our

Urokinase meets USP and EP standards (purity ≥99%) with transparent pricing,

supported by EU GMP certification and FDA DMF filings. For emerging markets, we

provide flexible bulk API pricing to support local manufacturers, aligning with

the region’s growing demand for affordable thrombolytic therapies3.

Regional clinical demand differences further shape Kangyuan’s Urokinase

price and formulation strategies. In Europe and North America, Urokinase is

primarily used for acute ischemic stroke (within 3-6 hours of onset)1, so we prioritize high-purity pre-filled syringes (500,000

IU, 1,000,000 IU) with premium pricing reflective of quality. In China, where

Urokinase is also widely used for hemodialysis catheter patency6, we offer lower-cost vial formulations (100,000 IU, 250,000 IU) to meet

high-volume hospital demand. Our advanced enzymatic purification process reduces

impurity levels by 40% compared to industry averages, ensuring consistent

bioactivity while controlling costs— a key advantage in stabilizing Urokinase

price amid raw material volatility.

As the global Urokinase market grows to $6.73 billion by 20253, navigating geo-driven price volatility becomes critical for partners

worldwide. Kangyuan’s unique advantage lies in our ability to deliver customized

Urokinase price solutions without sacrificing quality, backed by a resilient

supply chain and multi-regulatory compliance. Whether you’re a Chinese hospital

managing VBP procurement, a European distributor seeking USP-compliant

Urokinase, or an emerging market partner expanding thrombolytic portfolios, we

provide tailored support. Contact us today to explore our Urokinase portfolio,

secure stable pricing, and leverage our expertise to navigate the global

market’s price complexities.