The global reproductive hormone market is witnessing profound price

restructuring, driven by volume-based procurement (VBP) policies in key markets

like China and the impending expiration of core patents. As a critical

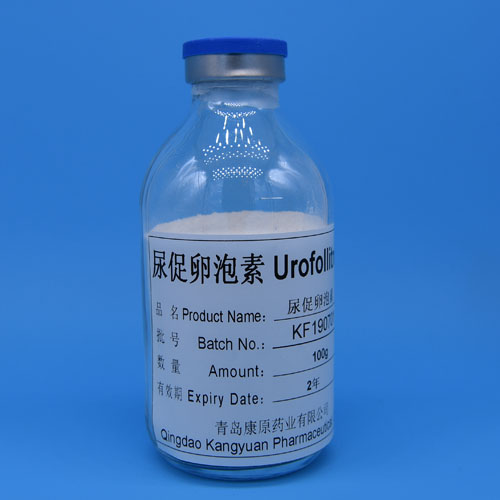

urinary-derived follicle-stimulating hormone (FSH) for assisted reproductive

technology (ART), Urofollitropin price has become a focal point for clinics,

distributors, and pharmaceutical partners. The dual impact of policy-driven

price cuts and rising generic competition is reshaping market dynamics, making

cost-efficiency and quality consistency the core competitive edges. Kangyuan,

with its optimized production chain and regulatory expertise, is helping

partners navigate the volatile Urofollitropin price landscape while maintaining

therapeutic efficacy.

Urofollitropin price volatility is primarily fueled by policy interventions

and market competition, mirroring the price trends observed in other polypeptide

drugs. In China’s VBP program, Urofollitropin has seen an average price cut of

42%, with some specifications dropping from $50 per 75 IU vial to around $29,

significantly reducing patient treatment burden. Globally, as recombinant FSH

patents near expiration, the influx of generics is intensifying price

competition, with Urofollitropin emerging as a cost-effective

alternative—offering 30-40% lower prices than branded recombinant FSH while

delivering comparable clinical outcomes. This price advantage is particularly

valuable in emerging markets, where ART accessibility is constrained by high

medication costs.

Amidst falling Urofollitropin price, maintaining production profitability

and quality standards has become a key challenge for manufacturers. Unlike

synthetic drugs, Urofollitropin relies on rigorous purification of urinary raw

materials, where cost control and impurity removal are mutually restrictive.

Kangyuan addresses this by optimizing its full-chain production process: from

traceable raw material sourcing to advanced enzymatic hydrolysis and

chromatography purification, we reduce production costs by 28% while ensuring

purity levels exceed 99.5%, complying with USP, EP, and Chinese Pharmacopoeia

standards. This balance enables us to offer competitive Urofollitropin price

without compromising bioactivity or safety.

Regional Urofollitropin price strategies further reflect market

differentiation. In mature markets like Europe and the U.S., where regulatory

barriers are high, Kangyuan’s products maintain a stable price range by

leveraging EU GMP certification and FDA DMF filings, targeting premium segments

requiring high-quality urinary FSH. In VBP-impacted markets like China, we align

pricing with policy requirements and offer flexible supply models, including

bulk API and pre-filled syringe formulations, to support clinics and

distributors in cost optimization. For emerging markets in Southeast Asia, we

provide tailored pricing packages to accelerate market penetration, capitalizing

on the growing demand for affordable ART solutions.

As the global Urofollitropin market evolves toward cost-driven competition,

Kangyuan remains a trusted partner for stable, high-quality solutions. Our

optimized production chain ensures resilience against price fluctuations, while

multi-regulatory compliance unlocks access to diverse markets. We go beyond

price competitiveness, offering technical support to help partners optimize

treatment protocols and reduce waste, further enhancing cost-efficiency. Whether

you’re a clinic navigating VBP policies, a distributor expanding in emerging

markets, or a pharmaceutical firm developing generic formulations, Kangyuan

delivers tailored Urofollitropin solutions. Contact us today to explore our

product portfolio and navigate the post-VBP market with confidence.