Urokinase, a vital thrombolytic enzyme derived from human urine, plays an

irreplaceable role in treating acute thromboembolic diseases and maintaining

catheter patency for hemodialysis patients. However, the global market has been

plagued by severe Urokinase price volatility and supply shortages in recent

years, posing significant challenges to healthcare facilities and patients

relying on this life-saving medication. Understanding the root causes of

Urokinase price fluctuations and partnering with a reliable manufacturer capable

of mitigating supply risks have become critical priorities for the medical

community worldwide.

The primary driver of Urokinase price surges lies in the fragility of its

raw material supply chain. Unlike synthetic pharmaceuticals, Urokinase is

extracted exclusively from healthy human urine, with most raw material sources

coming from remote areas and educational institutions. Disruptions such as

public health events can drastically reduce urine collection—during the

pandemic, school closures led to a sharp decline in raw material supply, causing

Urokinase price to skyrocket from approximately $4.5 per 100,000-unit vial to

over $27, with intermittent stockouts reported globally1.

This extreme volatility has strained healthcare budgets and forced clinicians to

seek suboptimal alternatives, which often fail to match Urokinase’s efficacy in

catheter maintenance and acute thrombolysis.

Market concentration further exacerbates Urokinase price instability, as

the global market is dominated by a handful of manufacturers, with the top three

accounting for nearly 50% of total supply2. While traditional

extraction methods remain the mainstream, innovative approaches like microbial

fermentation are emerging to reduce reliance on urine sources, potentially

stabilizing Urokinase price in the long term. Clinical data underscores the

urgency of ensuring stable supply: Urokinase not only serves as a first-line

therapy for acute myocardial infarction but also reduces myocardial damage and

improves cardiac function in patients with severe thrombus load, with no

increased bleeding risk3. For hemodialysis patients, there is

currently no fully equivalent alternative, making consistent access to Urokinase

a matter of patient safety.

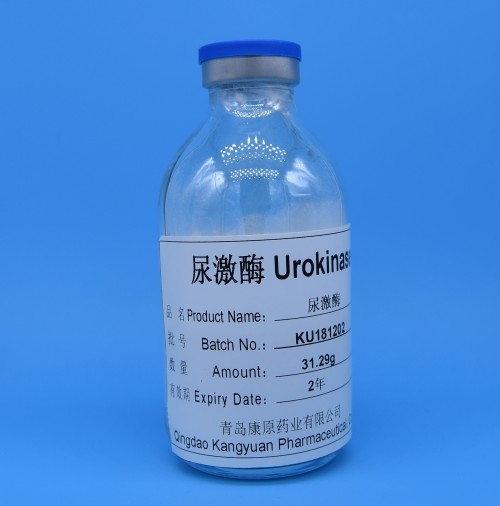

Addressing Urokinase price volatility requires a manufacturer with robust

upstream resource control and technological resilience. Kangyuan has established

a diversified, traceable raw material collection network, cooperating with

qualified institutions to ensure a steady supply of high-quality urine sources.

We also invest in advanced purification technologies to improve extraction

efficiency, mitigating the impact of raw material shortages on Urokinase price.

Our 100,000-unit and 500,000-unit formulations meet global pharmacopoeia

standards, with strict quality control to guarantee efficacy comparable to

leading brands while maintaining competitive pricing.

As the global demand for Urokinase continues to grow—with the market

projected to reach $673 million by 20252—Kangyuan remains

committed to ensuring stable supply and reasonable Urokinase price for

healthcare partners worldwide. Our integrated production system, from raw

material collection to finished product distribution, enables us to respond

quickly to market fluctuations and avoid the severe shortages affecting other

suppliers. Whether you are a hospital seeking reliable thrombolytic solutions, a

distributor navigating supply chain uncertainties, or a clinic in need of

consistent Urokinase supplies, Kangyuan’s professional team provides tailored

support. Contact us today to explore our Urokinase product portfolio and secure

a trustworthy supply partner for critical patient care.