Urofollitropin, a highly purified urinary follicle-stimulating hormone

(u-FSH) critical for ovulation induction in infertility treatment, has become a

mainstay in assisted reproductive technology (ART) protocols worldwide. As the

global urinary FSH market continues to expand—projected to grow from USD 241.58

million in 2023 to USD 335.00 million by 2029 with a CAGR of

5.60%—Urofollitropin price volatility has emerged as a key concern for

healthcare providers, fertility clinics, and patients. The cost of

urofollitropin therapy accounts for a significant portion of ART expenses,

making it essential to understand the factors influencing Urofollitropin price

and adopt effective procurement strategies to balance quality, efficacy, and

affordability. This article delves into the core drivers of price fluctuations

and offers actionable insights for optimizing clinical procurement.

Raw material supply and production technology are the primary determinants

of Urofollitropin price. Urofollitropin is derived from the urine of

postmenopausal women, a raw material whose availability is subject to

demographic changes and collection efficiency. Fluctuations in the global

postmenopausal population and regional differences in urine collection systems

can lead to supply shortages, directly driving up raw material costs.

Additionally, the traditional production process of urofollitropin involves

complex purification steps to achieve high purity, which is labor-intensive and

time-consuming, further contributing to production costs. In contrast,

recombinant FSH (r-FSH) products, though offering consistent potency, often come

with a higher price tag. Notably, clinical studies have confirmed that

highly-purified urofollitropin (HP-uFSH) achieves comparable efficacy to r-FSH

in ovulation induction while reducing treatment costs by up to 17%—a key

advantage that influences Urofollitropin price positioning in the market.

Technological advancements in purification processes, such as improved

chromatographic techniques, have helped mitigate some cost pressures by

enhancing yield and purity, but these innovations require significant upfront

investment, which is reflected in product pricing.

Global market dynamics and regulatory policies further shape Urofollitropin

price trends. The global urofollitropin market is characterized by intense

competition between urinary-derived and recombinant FSH products, with regional

preferences influencing price variations. In emerging markets such as Southeast

Asia and Latin America, where cost sensitivity is high, urofollitropin remains a

preferred choice due to its cost-effectiveness, driving steady demand and

relatively stable pricing. In contrast, developed markets in Europe and North

America, while valuing the consistency of r-FSH, still maintain demand for

urofollitropin in specific patient groups (e.g., clomiphene-resistant PCOS

patients), supporting a premium price segment. Regulatory policies also play a

crucial role: inclusion in national medical insurance catalogs in countries like

China and India has reduced patient out-of-pocket expenses but has also led to

price negotiations that compress manufacturer profit margins. Furthermore,

compliance with international quality standards (such as USP and EU GMP)

requires ongoing investment in quality control systems, which adds to production

costs and indirectly impacts Urofollitropin price.

For healthcare providers and fertility clinics, optimizing Urofollitropin

price management requires a strategic approach that balances cost and clinical

outcomes. First, partnering with reputable manufacturers that leverage advanced

production technologies can ensure consistent product quality while securing

competitive pricing through long-term supply agreements. Second, conducting

cost-minimization analyses tailored to specific patient populations—such as

prioritizing urofollitropin for patients with mild-to-moderate infertility where

it demonstrates cost-effectiveness—can reduce overall ART expenses. Third,

staying informed about regional regulatory changes and insurance coverage

updates helps in anticipating price fluctuations and adjusting procurement plans

accordingly. Additionally, exploring bulk procurement or group purchasing

arrangements can further lower unit costs, especially for large-volume clinics.

It is important to note that while Urofollitropin price is a key consideration,

product quality and safety must remain paramount, as substandard products can

lead to treatment failure and increased long-term costs.

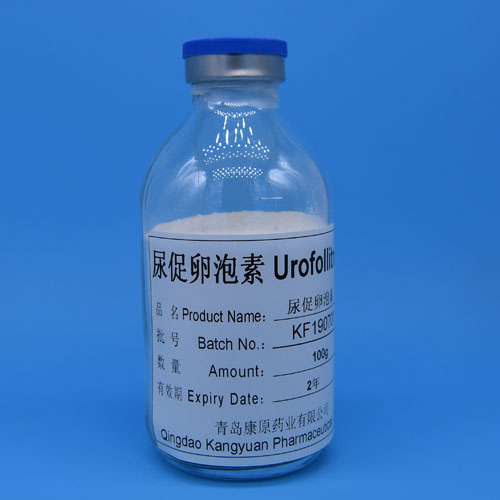

As a trusted provider of reproductive health pharmaceuticals, Kangyuan is

committed to delivering high-quality urofollitropin products at competitive

prices. Our advanced purification technologies ensure product purity and

consistency, meeting global regulatory standards (USP, EU GMP), while our

optimized production and supply chain management help mitigate Urofollitropin

price fluctuations. We offer tailored procurement solutions for healthcare

providers and fertility clinics, including long-term supply agreements and

technical support to optimize treatment protocols. Whether you are seeking

reliable urofollitropin supplies, need guidance on cost-effective ART

strategies, or require assistance with regulatory compliance, our professional

team is dedicated to providing personalized support. Contact Kangyuan today to

learn more about our urofollitropin products and how we can help you navigate

Urofollitropin price dynamics while ensuring optimal patient outcomes.